Dear Investor,

I present to you a comprehensive analysis of Samsung Electronics’ investment potential, particularly in comparison to its industry peer, SK Hynix. This report synthesizes the latest financial data and strategic positioning of Samsung Electronics to provide a clearer perspective on its future in the Korean stock market.

Overview of Samsung’s Position in Semiconductor Industry:

- Strategic Technological Advancements:

- Samsung is spearheading crucial developments in semiconductor technology, including DRAM scaling to sub-10nm, EUV lithography, and advanced NAND stacking (over 600 layers).

- The company’s focus extends to revolutionary paths over the next 30 years, like developing intelligent semiconductors and transitioning from PNM to PIM and ultimately to CIM (Computing In Memory).

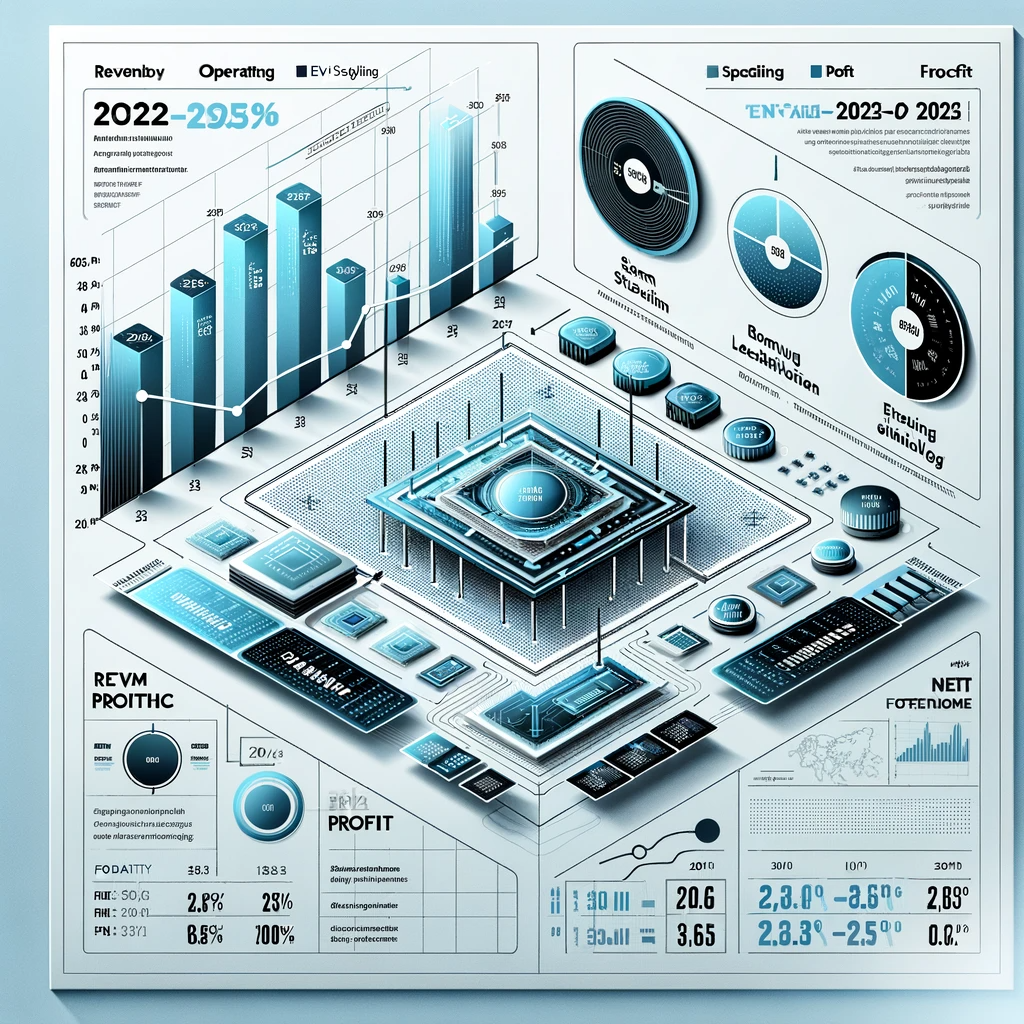

Financial Performance and Projections:

2022 Performance (Actual):

- Samsung experienced a modest revenue increase but faced significant declines in operating profit and net income, with a decrease in key metrics like ROE and an increase in debt ratio.

2023 Forecast:

- A challenging year is projected with expected declines in revenue, operating profit, and net income, indicating financial distress with negative EPS and ROE figures.

2024 and 2025 Forecasts:

- A strong recovery is anticipated in 2024, with substantial increases in revenue and operating profit. This trend is expected to continue into 2025, signaling a robust turnaround for the company.

Valuation and Investment Indicators:

- The company’s valuation metrics show volatility, particularly in PER, reflecting market perceptions and earnings fluctuations.

- The PBR remains stable, indicating that market valuation is in line with the company’s book value.

- The EPS is projected to recover from 2024, signaling potential growth for long-term investors.

Comparative Analysis with SK Hynix:

- Samsung’s extensive investment in both evolutionary and revolutionary semiconductor technologies could provide it with a competitive edge in the long term.

- While SK Hynix has shown significant growth, Samsung’s broader strategic focus might lead to sustained growth in market position and stock value.

Investment Considerations:

- Samsung’s financials reflect the cyclical nature of the semiconductor industry, with significant fluctuations in revenue and profit.

- The company’s robust R&D and strategic positioning indicate strong future potential.

- Investors should consider the current financial challenges and high volatility in financial metrics.

Conclusion and Recommendation:

Samsung Electronics, amidst its current challenges, is strategically positioned for long-term growth. Its technological advancements and potential market expansion make it an intriguing option for investors with a longer investment horizon. However, given the current financial distress and the cyclical nature of the industry, it would be prudent for investors to exercise caution and consider their risk tolerance before investing.

Based on the analysis, Samsung Electronics, with its strategic technological advancements and potential for a strong financial rebound in the coming years, appears to be a slightly more attractive investment option than SK Hynix. This assessment is particularly relevant for investors with a long-term perspective, looking to capitalize on Samsung’s future growth trajectory.

I trust this analysis offers a clearer perspective on the investment potential of Samsung Electronics in relation to SK Hynix.

Yours sincerely, Peter’s Club

P.S. For more detailed insights, especially concerning SK Hynix’s financials and market positioning, our paid subscription reports provide a deeper dive into these aspects, offering a comprehensive comparison between these two industry giants.